Find VA Homes in California

If you're a VA buyer and you're looking for a VA approved property, you've come to the right place. Simply fill out the short form above, and our system will find homes in California that are available for VA purchase. Please note that if you're looking for VA Condos, that you can go to the VA portal to search for VA condo approval. Click HERE for the VA condo portal. If you need further assistance, please feel free to email us.

Find VA Homes in California

If you're a VA buyer and you're looking for a VA approved property, you've come to the right place. Simply fill out the short form above, and our system will find homes in California that are available for VA purchase. Please note that if you're looking for VA Condos, that you can go to the VA portal to search for VA condo approval. Click HERE for the VA condo portal. If you need further assistance, please feel free to email us.

Spouses Eligibility with VA Benefits for a Mortgage

June 27, 2014

The VA Home loan is truly one of the last great loans available to the men and women who have served our country. It offers 100% Financing to a certain county limits as defined by the VA.

(For your county limit, please check HERE).

There is no mortgage insurance like an FHA loan, and there are certain fees that anybody applying for a VA loan cannot pay for in closing of the loan. These are knows as "Non Allowable" costs. The VA loan is available to veterans, current active duty, National Guard and reserve members.

Did you also know that it is available to a spouse of a veteran under certain conditions?

1. Un-remarried spouse of a Veteran who died while in service or from a service connected disability, or

2. Spouse of a Service member missing in action or a prisoner of war

3. Surviving spouse who remarries on or after attaining age 57, and on or after December 16, 2003 (Note: a surviving spouse who remarried before December 16, 2003, and on or after attaining age 57, must have applied no later than December 15, 2004, to establish home loan eligibility. VA must deny applications from surviving spouses who remarried before December 6, 2003 that are received after December 15, 2004.)

4. Surviving Spouses of certain totally disabled veterans whose disability may not have been the cause of death

While difficult to discuss, spouses are able to still use VA benefits. Do not let that dream fade away.

In addition, to being able to qualify for a VA loan, the surviving spouse of a veteran who died in service or from a service-connected disability will not be required to pay the standard funding fee on a VA loan. This fee is typically 2-3% and is waived by the VA.

Normal loan qualifications will still apply.

Spouses Eligibility with VA Benefits for a Mortgage

June 27, 2014

The VA Home loan is truly one of the last great loans available to the men and women who have served our country. It offers 100% Financing to a certain county limits as defined by the VA.

(For your county limit, please check HERE).

There is no mortgage insurance like an FHA loan, and there are certain fees that anybody applying for a VA loan cannot pay for in closing of the loan. These are knows as "Non Allowable" costs. The VA loan is available to veterans, current active duty, National Guard and reserve members.

Did you also know that it is available to a spouse of a veteran under certain conditions?

1. Un-remarried spouse of a Veteran who died while in service or from a service connected disability, or

2. Spouse of a Service member missing in action or a prisoner of war

3. Surviving spouse who remarries on or after attaining age 57, and on or after December 16, 2003 (Note: a surviving spouse who remarried before December 16, 2003, and on or after attaining age 57, must have applied no later than December 15, 2004, to establish home loan eligibility. VA must deny applications from surviving spouses who remarried before December 6, 2003 that are received after December 15, 2004.)

4. Surviving Spouses of certain totally disabled veterans whose disability may not have been the cause of death

While difficult to discuss, spouses are able to still use VA benefits. Do not let that dream fade away.

In addition, to being able to qualify for a VA loan, the surviving spouse of a veteran who died in service or from a service-connected disability will not be required to pay the standard funding fee on a VA loan. This fee is typically 2-3% and is waived by the VA.

Normal loan qualifications will still apply.

VA Home Loans And How They Work

June 20, 2014

While there are many different types of mortgage loans available, some will tell you that a VA loan is the single best type of mortgage available today. Why? Obviously you have to qualify for your entitlements, but for those that do, the VA mortgage has it’s distinct advantage over it’s counterparts.

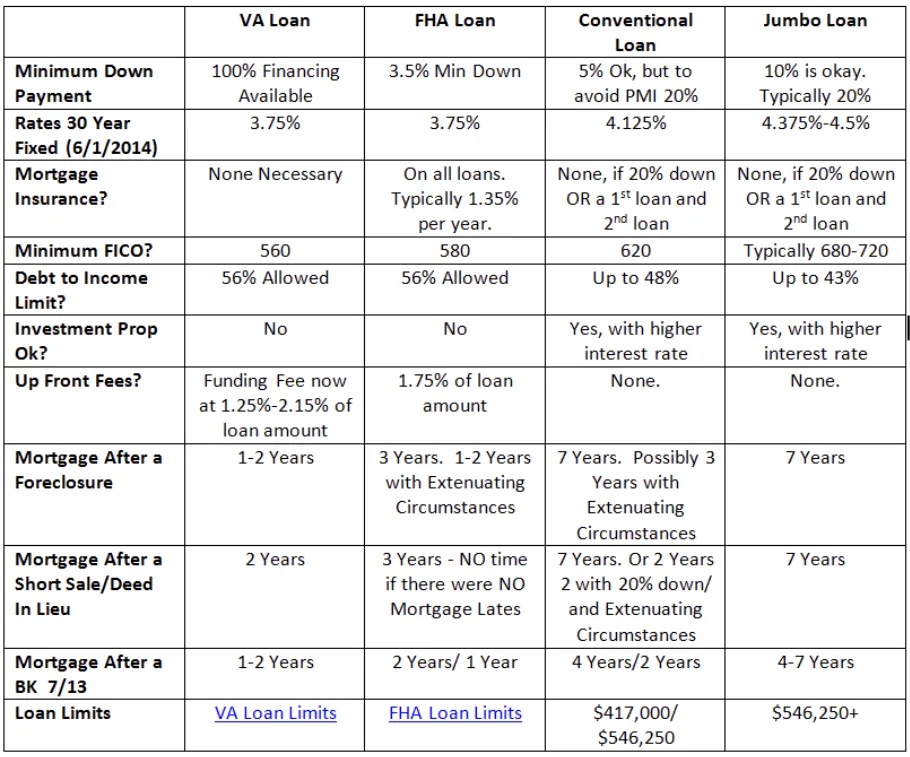

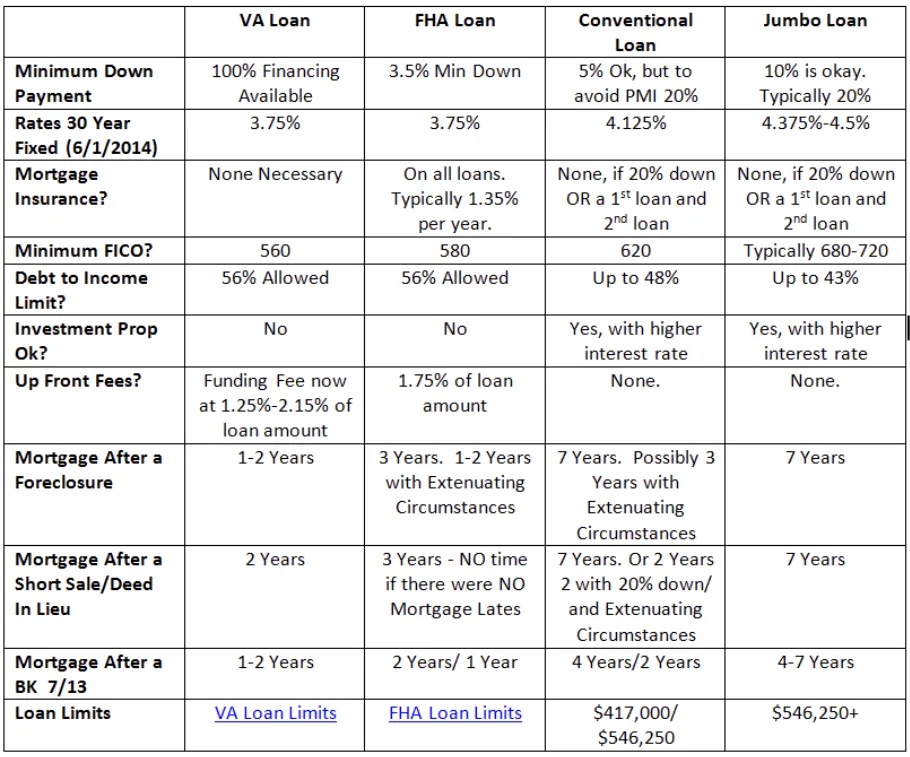

To better understand this, you have to better understand the different loan available today. The grid below is designed to help you better understand the benefits of getting a VA loan, and how they compare against other loans. The VA is extremely flexible when it comes to foreclosures, Short sales, Interest Rates and Debt to Income Ratio Maximum Amounts.

The primary drawbacks to a VA loan are limited. They typically include the VA funding fee that can range from 1.25%-1.75% of the loan amount for a “first time use” up to 3.3% for “subsequent uses."

Also, for those that are planning on buying a home, the VA has non allowable fees. These are fees that you as a VA buyer are not allowed to pay for in conjunction with you loan. While this may sound good, the reality of it is that while the VA buyer doesn’t have to pay this fee, somebody does. Typically these fees are requested of the seller, and can amount up to 1% of the sales price. This puts the VA buyer at a disadvantage if there are multiple offers on the property.

Some lenders have ways around this issue. Nick Vaccaro with C2 lending will cover all of your non allowables up to 1%. If you’re looking for a great VA lender and don’t want to miss out because you’re using your VA entitlements, his group can keep you in the running.

IF you’re looking for a great website to track VA approved properties in San Diego, go to www.vahomescalifornia.com. This site offers you the ability to check for VA eligibility on a home and will send you automatic updates of homes becoming available that you may be interested in. The site has gained quite a bit of notoriety with local VA as it provides a wealth of information for those that need a VA loan.

VA Home Loans And How They Work

June 20, 2014

While there are many different types of mortgage loans available, some will tell you that a VA loan is the single best type of mortgage available today. Why? Obviously you have to qualify for your entitlements, but for those that do, the VA mortgage has it’s distinct advantage over it’s counterparts.

To better understand this, you have to better understand the different loan available today. The grid below is designed to help you better understand the benefits of getting a VA loan, and how they compare against other loans. The VA is extremely flexible when it comes to foreclosures, Short sales, Interest Rates and Debt to Income Ratio Maximum Amounts.

The primary drawbacks to a VA loan are limited. They typically include the VA funding fee that can range from 1.25%-1.75% of the loan amount for a “first time use” up to 3.3% for “subsequent uses."

Also, for those that are planning on buying a home, the VA has non allowable fees. These are fees that you as a VA buyer are not allowed to pay for in conjunction with you loan. While this may sound good, the reality of it is that while the VA buyer doesn’t have to pay this fee, somebody does. Typically these fees are requested of the seller, and can amount up to 1% of the sales price. This puts the VA buyer at a disadvantage if there are multiple offers on the property.

Some lenders have ways around this issue. Nick Vaccaro with C2 lending will cover all of your non allowables up to 1%. If you’re looking for a great VA lender and don’t want to miss out because you’re using your VA entitlements, his group can keep you in the running.

IF you’re looking for a great website to track VA approved properties in San Diego, go to www.vahomescalifornia.com. This site offers you the ability to check for VA eligibility on a home and will send you automatic updates of homes becoming available that you may be interested in. The site has gained quite a bit of notoriety with local VA as it provides a wealth of information for those that need a VA loan.

How to guarantee that you’ll get the best interest rate on your home mortgage. This simple trick will save you thousands.

May 21, 2014

While there are many options available for home mortgages, one of the biggest secrets in the industry is the fact that there are many organizations that fall outside of typical disclosure regulation. Unless you’ve lived under a rock on Mars for the last number of years, you’re infinitely aware of the new regulation that has been created in an effort to help the consumer. Unfortunately, in a lot of areas, its in fact done just the opposite, and unless you’re aware of these new changes you could be putting yourself in a losing position against your mortgage lender.

IF you get a loan from one of these organizations, you’ll get a higher interest rate and will be out thousands of dollars.

The mortgage industry is regulated by three entities that license the organization and give them the ability to grant loans. They are:

1. The BRE (The Bureau of Real Estate

2. The DBO (The Business

3. Retail

The issue is that most people will fall to a very simple trap.

When shopping for a home mortrage DO NOT compare pricing from one licensing organization to the next.

Rather compare prices from different licensing organizations.

Why?

Companies that are licensed under the DBO and retail do not need to disclose their compensation.

Additionally, they get to keep any rebate that should come back to the client. While this seems somewhat intuitive, if a client shops three retail lenders against one another (B of A, Wells, CHASE), then they’re only getting what these three entities can offer. In other words there may not be a huge variance and the client will typically acquiesce to a higher than normal interest rate.

Wholesale lenders on the other hand almost ALWAYS have better interest rates.

How to guarantee that you’ll get the best interest rate on your home mortgage. This simple trick will save you thousands.

May 21, 2014

While there are many options available for home mortgages, one of the biggest secrets in the industry is the fact that there are many organizations that fall outside of typical disclosure regulation. Unless you’ve lived under a rock on Mars for the last number of years, you’re infinitely aware of the new regulation that has been created in an effort to help the consumer. Unfortunately, in a lot of areas, its in fact done just the opposite, and unless you’re aware of these new changes you could be putting yourself in a losing position against your mortgage lender.

IF you get a loan from one of these organizations, you’ll get a higher interest rate and will be out thousands of dollars.

The mortgage industry is regulated by three entities that license the organization and give them the ability to grant loans. They are:

1. The BRE (The Bureau of Real Estate

2. The DBO (The Business

3. Retail

The issue is that most people will fall to a very simple trap.

When shopping for a home mortrage DO NOT compare pricing from one licensing organization to the next.

Rather compare prices from different licensing organizations.

Why?

Companies that are licensed under the DBO and retail do not need to disclose their compensation.

Additionally, they get to keep any rebate that should come back to the client. While this seems somewhat intuitive, if a client shops three retail lenders against one another (B of A, Wells, CHASE), then they’re only getting what these three entities can offer. In other words there may not be a huge variance and the client will typically acquiesce to a higher than normal interest rate.

Wholesale lenders on the other hand almost ALWAYS have better interest rates.

VAHomesCalifornia.com Goes Live

May 20, 2014

If you’re a VA eligible home buyer, a new service is available for you to help you look for VA eligible properties in San Diego. VAHomesCalifornia.com is a one stop location that allows VA buyers the opportunity to search for VA homes in the San Diego area. Once you’ve searched the site, your search will be saved, and you’ll be emailed daily updates of properties that fit your search.

While there are many websites that offer MLS access to homes in San Diego, none have the tools that have been specifically built to suit the needs of VA Home Buyers. The site was launched in May of 2014, and has been steadily gaining support amongst local VA eligible buyers that are looking for Real Estate in San Diego.

Need a home mortgage too? VAHomesCalifornia.com has also partnered up with California’s largest wholesale lender to offer some of the most competitive rates available to our Military home buyers.

One of the drawbacks for VA home buyers is the VA “non allowables". These fees are typically paid by “any interested party” and can usually result in thousands of dollars of costs to the seller or the Real Estate Agents.

Because of this added fee, the VA homebuyer is often at a disadvantage when there are multiple offers on a property. Nick Vaccaro with C2 Financial will cover the VA non allowables up to 1% on all loans, thus putting the home buyer back into contention of getting the home that they’re putting an offer on.

If you’re VA eligible and you’re looking for a home in San Diego, VAHomesCalifornia.com is a great resource that will send you daily updates on new homes in the area that fit your requirements that are VA eligible.

If you’re a Real Estate agent that is looking for guidance on a VA purchase, feel free to contact Nick Vaccaro for direction on how you can become more competitive on your VA offers.

VAHomesCalifornia.com Goes Live

May 20, 2014

If you’re a VA eligible home buyer, a new service is available for you to help you look for VA eligible properties in San Diego. VAHomesCalifornia.com is a one stop location that allows VA buyers the opportunity to search for VA homes in the San Diego area. Once you’ve searched the site, your search will be saved, and you’ll be emailed daily updates of properties that fit your search.

While there are many websites that offer MLS access to homes in San Diego, none have the tools that have been specifically built to suit the needs of VA Home Buyers. The site was launched in May of 2014, and has been steadily gaining support amongst local VA eligible buyers that are looking for Real Estate in San Diego.

Need a home mortgage too? VAHomesCalifornia.com has also partnered up with California’s largest wholesale lender to offer some of the most competitive rates available to our Military home buyers.

One of the drawbacks for VA home buyers is the VA “non allowables". These fees are typically paid by “any interested party” and can usually result in thousands of dollars of costs to the seller or the Real Estate Agents.

Because of this added fee, the VA homebuyer is often at a disadvantage when there are multiple offers on a property. Nick Vaccaro with C2 Financial will cover the VA non allowables up to 1% on all loans, thus putting the home buyer back into contention of getting the home that they’re putting an offer on.

If you’re VA eligible and you’re looking for a home in San Diego, VAHomesCalifornia.com is a great resource that will send you daily updates on new homes in the area that fit your requirements that are VA eligible.

If you’re a Real Estate agent that is looking for guidance on a VA purchase, feel free to contact Nick Vaccaro for direction on how you can become more competitive on your VA offers.

Nick Vaccaro

C2 Financial Corporation

CalState Realty Services

BRE #01821025 | NMLS #135622

10509 Vista Sorrento Parkway, Suite #400

San Diego, CA 92121

858-217-5363

Copyright © 2011 - 2023

All Rights Reserved | CalState Realty Services

Privacy Policy